Treatt plc announces today its results for the year ended 30 September 2021.

Commenting on the results, CEO Daemmon Reeve said:

“We are very proud to be reporting record full year results for Treatt against all of our key metrics. It has been a remarkable performance in a year when we have been dealing with the continued impact of the COVID-19 pandemic and volatility in market conditions. We have managed to deliver really strong profit growth across multiple categories, particularly through aligning with consumer beverage trends and the wide demand for healthier, natural products. This has all happened while continuing to invest in the future growth potential of the business.

This strong performance is testament to the efforts of everyone at Treatt, who I would like to thank.

We are making the right investments at the right time on our growth journey. I have no doubt that the combined effect of increasing our investment in R&D, realising the multitude of benefits from the new UK headquarters and strengthening our team will elevate Treatt to a new level with further sustained benefits to all of our stakeholders.”

OPERATIONAL HIGHLIGHTS (1):

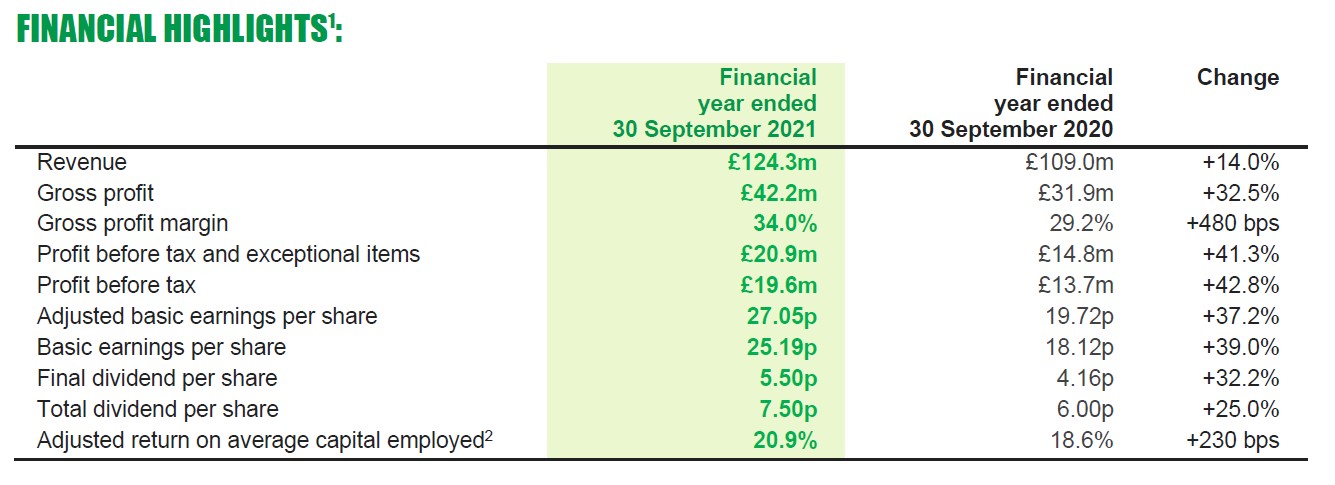

- Increased revenue driven by growth across multiple addressable markets.

- Gross profit margin grew by 480bps, led by growth in healthier living categories.

- Profit before tax and exceptional items up 41.3% to £20.9m – substantially exceeding Board’s initial expectations.

- Diversification of portfolio continues: almost 80% of Group revenue from higher margin natural and clean-label products.

- Successfully navigated COVID-19 challenges, and no material impact from global supply chain issues.

- Ongoing capital investment for future growth:

Phase one installation and commissioning of plant and machinery is due to be complete mid-2022.

Phase two transfer of manufacturing equipment from old facility due to be completed by mid-2023. - Embedding sustainability strategy across Group.

- Confident in the outlook – continued strong growth in revenue expected, with reversion to normal H1 / H2 split.

(1) All measures based on continuing operations

(2) Adjusted return on average capital employed is calculated by dividing operating profit before exceptional items (as shown in the Group income statement) by the average capital employed in the business, which is calculated as total equity (as shown in the Group balance sheet) plus net debt or minus net cash (as shown in the Group reconciliation of net cash flow to movement in net cash), averaged over the opening, interim and closing amounts.

Read more about the Treatt plc full year results year ended 30 September 2021.